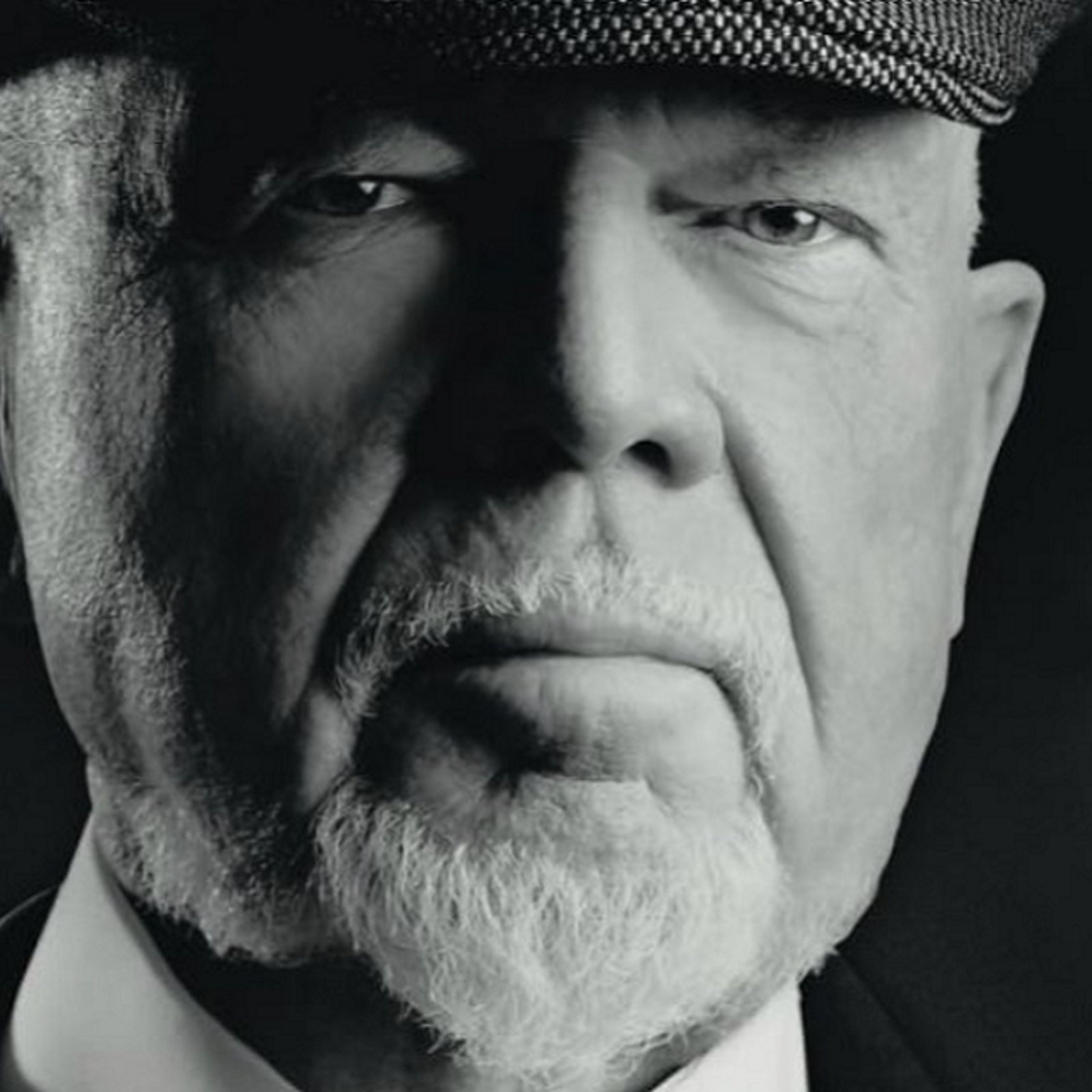

Leafs captain John Tavares facing legal battle against CRA

Tavares could end up having to pay up big time.

Toronto Maple Leafs captain John Tavares is facing the unfortunate possibility of having to pay up big time to the Canadian Revenue Agency.

Tavares, who signed a seven year, $77 million deal with the Leafs in 2018, was paid a $15.5 million signing bonus, but the CRA is claiming it should be taxed as part of his regular salary, meaning he could owe as much as $8 million.

Via City News Toronto:

The CRA “denies that any amount referred to as a ‘signing bonus’ was a signing bonus or an inducement payment,” the government said in a response to Tavares’ tax appeal, filed last week in the Tax Court of Canada.

It adds, “the amount of USD $70,890,000 was not paid to [Tavares] as consideration for entering into, or as an inducement to sign, the Contract.”

Under a Canada-US tax treaty, signing bonuses and other inducements for athletes, artists, actors and musicians get special treatment and are taxed at a low 15 per cent rate. But if all of the money paid to Tavares under the seven-year deal with the Leafs was treated as normal income, it would likely be taxed at the top marginal federal rate of 33 per cent, plus the provincial Ontario tax.

Higher taxes north of the American border has been listed among the reasons why higher profile athletes sometimes shy away from playing in Canadian markets, and this certainly won't do much to aid that situation.

Recommended articles: